How to Trade Cryptocurrency in the UK

Cryptocurrency trading has gained immense popularity in the UK, and understanding the basics is crucial for success.

Getting Started with Cryptocurrency Trading

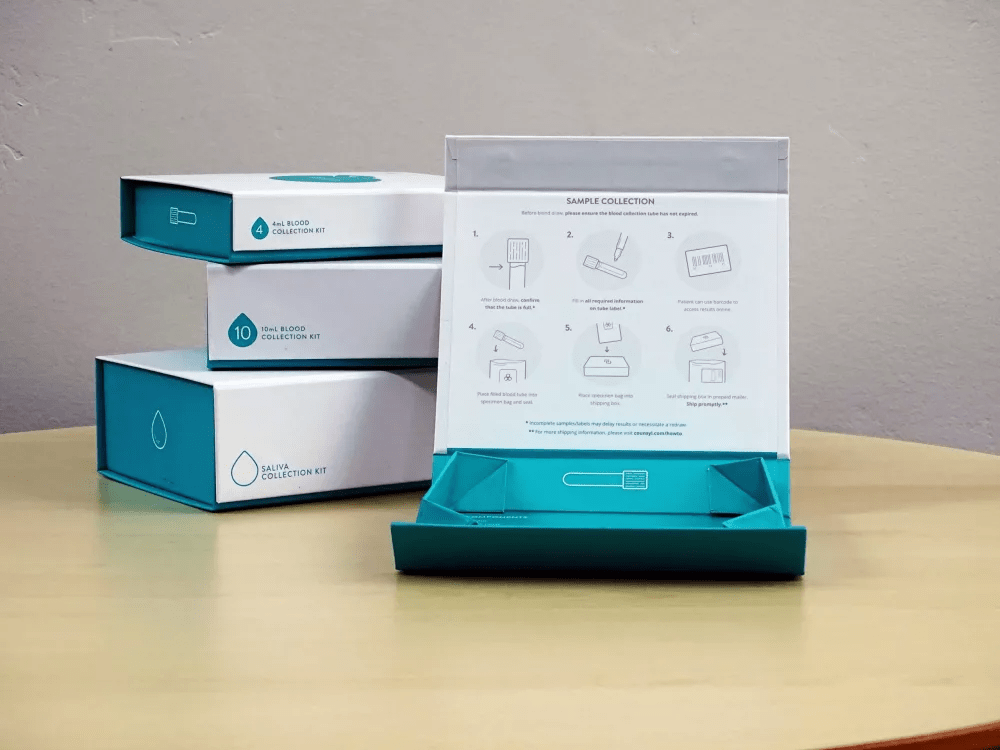

Before diving in, grasp the essentials. Explore wallet options, exchanges, and the importance of secure storage.

Analyzing the Cryptocurrency Market

Learn the art of market analysis. Understand charts, trends, and indicators to make informed trading decisions.

Crafting a Solid Cryptocurrency Trading Strategy

Risk Management in Cryptocurrency Trading

Mitigate risks by developing a robust risk management strategy. Learn to set stop-loss orders and diversify your portfolio.

Choosing the Right Cryptocurrencies to Trade

Navigate the vast array of cryptocurrencies by understanding factors like market capitalization, utility, and technology.

Navigating Cryptocurrency Regulations in the UK

Understanding UK Cryptocurrency Regulations

Stay compliant by comprehending the regulatory landscape. Know the tax implications and reporting requirements.

Choosing a Reputable Cryptocurrency Exchange

Selecting the right exchange is crucial. Evaluate factors such as security, fees, and available trading pairs.

Advanced Cryptocurrency Trading Strategies

Leveraging Margin Trading

Explore the world of margin trading cautiously. Learn the potential benefits and risks associated with trading on margin.

Utilizing Technical Analysis for Trading Success

Master technical analysis to predict price movements effectively. Dive into candlestick patterns, Fibonacci retracements, and more.

Staying Informed and Adapting to Market Changes

Continuous Learning in Cryptocurrency Trading

Stay ahead by keeping abreast of market trends, news, and emerging technologies. Embrace a mindset of continuous learning.

Adapting to Market Changes and Volatility

Cryptocurrency markets are dynamic. Learn to adapt to sudden changes and navigate through market volatility.

Mastering cryptocurrency trading in the UK requires knowledge, strategy, and adaptability. Arm yourself with the tools needed to thrive in this exciting and evolving financial landscape.

AED To Naira

The exchange rate between the United Arab Emirates Dirham (AED) and the Nigerian Naira is a critical aspect of international finance. Investors, businesses, and individuals closely monitor this rate as it influences trade, investments, and remittances between the two nations. Understanding the dynamics of the AED to Naira exchange rate involves considering economic indicators, geopolitical factors, and global market trends. As these currencies play pivotal roles in their respective regions, staying informed about their exchange rate fluctuations is essential for making informed financial decisions.